The Interactive Advertising Bureau’s mid-2020 study reported a 15% drop in advertising growth compared to pre COVID-19 projections, based on self-disclosure by companies. However, the year-on-year growth was still expected to be positive compared to 2019. This was further enhanced by Omnicom Media Group's announcement in July 2020 that it would spend US$20 million in advertising on podcasts distributed by Spotify during the second half of the year.

With both advertising revenue and listenership taking a hit especially as we entered the second quarter of the year, podcasters worked to diversify their streams, specifically audience-based revenue. Patreon reported over 30,000 new creators signed up for the service in the few weeks of March alone, and announced a US$90 million round in funding in September.

US-based podcast network Relay FM, for example, introduced show-level membership for flagship shows such as Connected and Upgrade in addition to their already running company-wide membership, while the Accidental Tech Podcast introduced audience membership for the first time in its 400 episode history. Jordan-based podcast company Sowt introduced their membership program ‘Sowt Plus’ with the option to pay up to US$8 monthly to support their content.

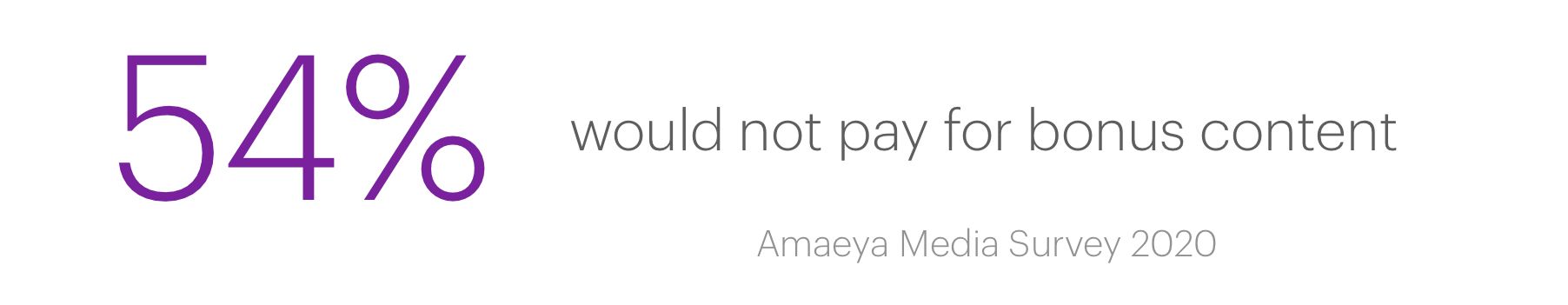

Consumers in the region though are typically reluctant to pay or subscribe to content behind a paywall. 54% of listeners said they wouldn’t pay for any bonus content, while 51% of those willing to pay said they would pay $1 monthly, setting a low bar for content-based revenue.

Advertising will not remain a sustainable income for creators, which will require more robust monetisation plans to cover production costs, which is why platforms are looking to silo their content. I believe the fundamental nature of RSS podcasts will eventually change for the benefit of the creator; Subscription Audio on Demand (SAoD) and Transactional Audio on Demand (TAoD) models will further emerge.”

Stefano Fallaha

CEO, Podeo

While advertising revenue is projected to bounce back and hit the US$2 billion target that was expected for 2020, exploring alternative revenue streams will continue to be an important challenge to tackle over the next 24 months.

Next: An Exclusive World >The Year That Was • Changing Habits

Brands in Podcasts • Monetisation • An Exclusive World

Standardisation • The Podcast Index • The Podcast Academy

Conclusion