The open versus closed or siloed debate has been brewing for some time, and was brought to a head in a year dominated by Spotify and exclusive content. Podcasts as a medium, including its backbone RSS, have always been decentralized, allowing creators any choice of host, and listeners a number of options to listen—from default smartphone apps to streaming services to independent apps. Jio Saavn launched a hosting product for podcasts, while streaming service Amazon Music joined the podcasts bandwagon during 2020.

Spotify continued building on their acquisitions from 2019, expanding to milestone content deals during the year. The news of the Joe Rogan Experience moving exclusively to Spotify in May set a few cats among the pigeons, especially since the estimated US$100 million deal also included the removal of all published content from podcast platforms as well as YouTube.

At the time, Chirag Desaiesai, CEO at Amaeya Media, noted that “Apple had for too long been the untouched ‘father figure’ in the podcast space [...] without making any direct monetary gains from the medium. The gap was always available for someone ‘else’ to jump in with a business model and tip the scales, and Spotify is now that company.”

Spotify went on to sign Michelle Obama and Kim Kardashian West among others. In the case of the The Michelle Obama Podcast however, Spotify opened up its release to other platforms after a 30-day window during which episodes remained exclusive on the platform. Prince Harry & Princess Meghan’s launched their audio-first company Archewell Audio, and also went on to sign an exclusive multi-year deal with Spotify.

Apple kicked off their production efforts with the launch of Apple News Today in a similar vein; while it did not have a publicly listed RSS-feed, the show itself is not locked and other players started listing it within a few weeks. News continues to circulate that Apple is exploring original content that may serve as supplementary content to their Apple TV+ service. For example, Oprah Winfrey launched Oprah’s Book Club, a podcast that is part of a larger collaboration with the company that includes a television series of the same name.

The New York Times went out and bought subscription-based audio app Audm and Serial Productions, the company behind Serial that was looking for a buyer in early 2020. This added to big ticket acquisitions this year including Spotify’s Megaphone purchase, and Amazon Music’s acquisition of Wondery, with the goal to further create exclusive content.

In a nutshell, the traditionally open world of podcasts was met heads-on this year with platforms working on siloed content and shows, with or without a paywall.

Last year, Luminary received flak from creators for attempting to paywall content behind their subscription plans in 2019[1], although services like Stitcher have offered free-to-air podcasts and a premium tier for ad-free or exclusive content for a few years.

In terms of listenership, these moves seem to have a positive impact for the platforms themselves. Spotify noted in their yearly review that more 18-24 year olds listened to a podcast on their platform for the first time during 2020, with similar trends in India.

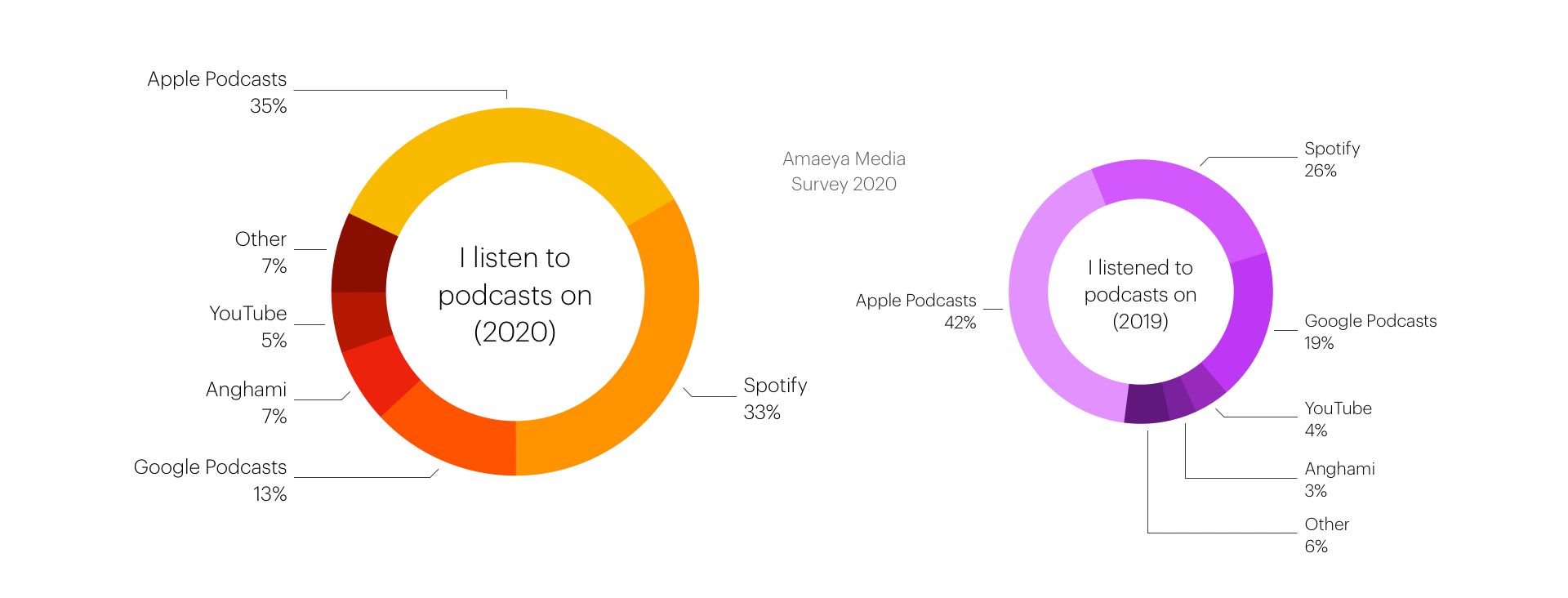

Spotify gained locally as well, seeing a seven-point bump in being the preferred podcast player compared to last year and closing in on Apple Podcasts’ traditional lead in the region. Anghami also saw an improvement in their share of listenership compared to 2019, while YouTube still remains in contention as a place to consume video versions of podcasts. This is also a consequence of the year, with more creators recording their shows over platforms like Zoom this year. As shows return to in-person recordings over the year, this may change however.

As much as we can draw parallels to the streaming world—where Netflix, Apple, HBO and Disney have been gearing up for quite the battle—and a future where platforms charge a subscription to access exclusive content on top of ‘free-to-air’ shows, this also starts to challenge the fundamental meaning of what a podcast is to begin with. Podcasters would argue that a show without an openly available RSS-feed isn’t a podcast at all, yet general public understanding of a podcast seems to be an ‘audio show’, even as that itself is being challenged by the podcasts-on-YouTube phenomenon.

Even as more companies follow Spotify’s lead, the real impacts of this tussle may take some time to really take shape, especially for creators. For example, workers from Gimlet Media and The Ringr unionised in 2019 in order to protect their rights. They were joined this year by podcast production company Parcast—all three companies are acquired by Spotify.

Further, the creators of Gimlet’s The Nod, Brittany Luse and Eric Eddings, were vocal about their loss of ownership of the show’s brand due to the acquisition, something they realized they needed to address when they wanted to expand the show beyond just the podcast during the pandemic. Other podcast creators also found Spotify’s podcasting section carrying bootlegged versions of popular songs, while Anchor has been plagued with a high degree of podcast piracy since they are able to bypass Apple’s approval process.

For one of the last bastions of the open web though, the implications of this model becoming successful—such that we start seeing the same divide between the indie and the mainstream as we do in nearly every other medium today—is disappointing. And while I do think that podcasting’s roots are deep enough that this may be just a blip in the radar—we already know what happens once mainstream funding starts driving a medium’s long-term growth.”

Chirag Desai

CEO, Amaeya Media

Spotify was also at the receiving end of backlash due to content published by the Joe Rogan Experience after the show moved to the platform. While Spotify took a position defending the expression of the creator in this case, instances such as these continue to bring to light questions about how much a platform would have to police or control content on their platform especially when exclusive or siloed, and where those lines may need to be re-drawn.

These are all elements to watch out for as the on-going consolidation finds some equilibrium in 2021, while the economic viabilities of this approach will be put to the test.

An experiment largely regarded as failed, with Luminary reportedly incurring monthly losses of US$4 million. This is despite raising US$30 million in May, which came at a valuation lower than their previous round. ↩︎

The Year That Was • Changing Habits

Brands in Podcasts • Monetisation • An Exclusive World

Standardisation • The Podcast Index • The Podcast Academy

Conclusion